Not sure if anyone will be interested in this, but I occasionally talk about this issue in my classes and finally found a document to illustrate my point.

Our health care system in the US makes little to no sense, in large part due to health insurance companies. From what I understand, health insurance companies negotiate prices with health insurance providers for pretty much every service they cover (when they cover services). Thus, the health care provider (your doctor) charges some price for a service but the insurance company pays a different price.

So, an example: Let’s say you go to a doctor for a visit. The doctor charges you $100 for the visit. The bill goes to your insurance provider, who has negotiated ahead of time to only pay $50 for a doctor’s visit. So, your insurance company pays it’s percent of the negotiated amount – 80% or $40 – and you pay your percent – 20% or $10.

Here’s the kicker: If you don’t have health insurance, you still get charged the full amount by your doctor – $100, no discount applied (some times they do, but often they don’t). Now, this may not be a big deal if you’re only talking about a doctor’s visit for $100. But what if it’s a $1000 charge, or $10,000? Now it’s an issue of really screwing over the uninsured.

Additionally, insurance companies increasingly want all expenses to go through them – you don’t even pay co-pays anymore. This makes it so individuals have no idea how much their health care actually costs. I don’t remember the last time I went to a doctor’s office and the doctor actually told me the up front cost of a procedure or visit. This way, the insurance companies are like a big black box – health care providers submit charges, the insurance companies pay whatever they pay, and they pass on a certain percent to the consumer. This puts the insurance companies in almost complete control of health care in the US. Consider what life would be like if all of your purchases worked this way:

You walk into Best Buy to buy a TV. When you walk in, you have to sit down and fill out a form that asks about your purchasing history to make sure you will have no complications purchasing anything at Best Buy. There are no prices on any TVs, but you talk to someone in the store who tells you that you “need” the 46 inch flat panel TV. You agree and tell him you’ll take it. You pull out your “merchandise insurance card” and hand it over. He photocopies it, tells you to sign a piece of paper, then sets up a follow up visit to consider universal remotes. They load the TV into your vehicle and you drive it home. Several weeks later your “merchandise insurance company” sends you a bill. Best Buy charged them $10,000 for the TV, but they have a discount negotiated with them of $8,000, so the TV is only $2,000. You pay 20%, so you owe $400. Of course, to use this “merchandise insurance company” you also pay them about $500 per month for a family plan and your employer pays an additional $1,000 per month. So, your insurance company makes $1,500 per month and doesn’t pay full price for services. If you don’t have “merchandise insurance,” you pay the full price at Best Buy. Who would buy anything this way if you have no idea how much it will eventually cost you?

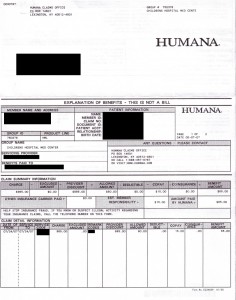

So, I was getting rid of 2007’s financial records when I came across a bunch of notices from our old health insurance company. The one I scanned is great. I won’t say what it is for, but the charge from the health care service provider was $965. The discount for the insurance provider: $885. That’s a 92% discount. That leaves $80 to be paid. Our co-pay at the time was $15. Which means the health insurance company paid $65 out of $965 charged to it, or 7% of what it was charged.

How many times have you heard someone say, “Thank god we have insurance”? Are we really lucky to have health insurance? Health insurance seems like a good idea when it is used to spread out the cost of major healthcare expenses. But today it is generally used just to enrich people: catostrophic health care is passed on to the government because the health care companies either drop them or won’t take them for pre-existing conditions. They also try to find as many things as possible to not cover. That leaves health insurance companies providing insurance just for the healthy, who have lower costs. Then they get discounts and pass some of the cost on to you. You pay for the privilege to not know how much you have to pay. It’s time for a new system…

![]()

Leave a Reply